Introduction

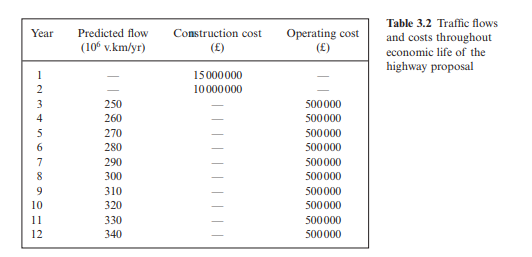

It is proposed to upgrade an existing single carriageway road to a dual carriageway and to improve some of the junctions. The time frame for construction of the scheme is set at two years, with the benefits of the scheme accruing to the road users at the start of the third year. As listed above, the three main benefits are taken as time savings, accident cost savings and vehicle operating cost reductions. Construction costs are incurred mainly during the two years of construction, but ongoing annual maintenance costs must be allowed for throughout the economic life of the project, taken, in this case, to be 10 years after the road has been commissioned.

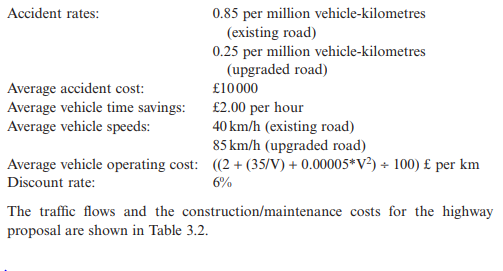

The following basic data is assumed for this analysis:

Computation of discounted benefits and costs

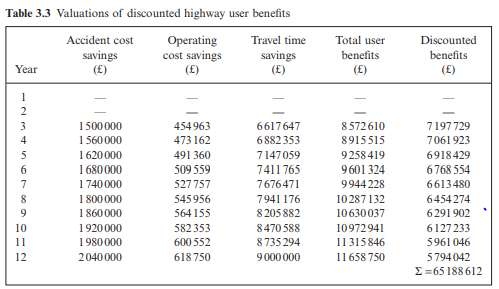

Table 3.3 gives the valuations for the three user benefits over the 10 years of the upgraded highways operating life.

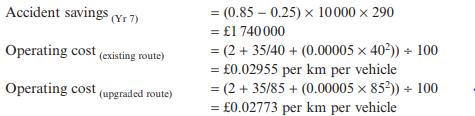

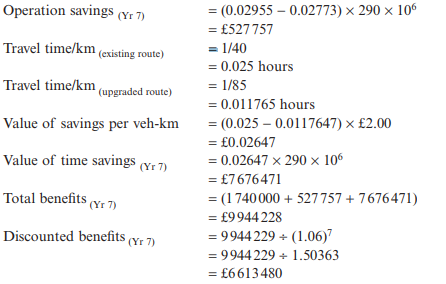

Taking the computations for year 7 as an example, the three individual user benefits together with their total and discounted value are calculated as follows:

These calculated figures are given in row seven of Table 3.3. The results of the computation of user benefits for all relevant years within the highway’s economic life are shown in this table. It can be seen that the discounted value of the total benefits amounts to £65 188 612.

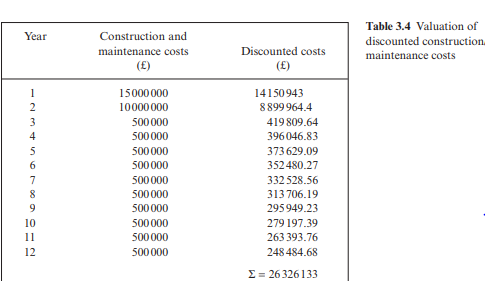

Table 3.4 gives the construction and maintenance costs incurred by the project over its economic life together with the discounted value of these costs.

As seen from Table 3.4, the total value of the discounted costs of the upgrading project is estimated at £26 326 133.

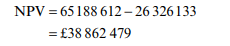

The computations contained in Tables 3.3 and 3.4 are used to estimate the economic worth of the project. This can be done using the three indicators referred to earlier in the chapter: net present value, benefit/cost ratio and internal rate of return.

Net present value

To obtain this figure, the discounted costs are subtracted from the discounted benefits:

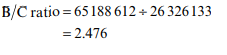

Benefit-cost ratio

In this case, the discounted benefits are divided by the discounted costs as follows:

Internal rate of return

This measure of economic viability is estimated by finding the discount rate at which the discounted benefits equate with the discounted costs. In this example, this occurs at a rate of 28.1%.

Comments are closed